Breaking news: After April 1, 2024, Russia will tighten regulations on automobile imports, including tariffs and market certification requirements.

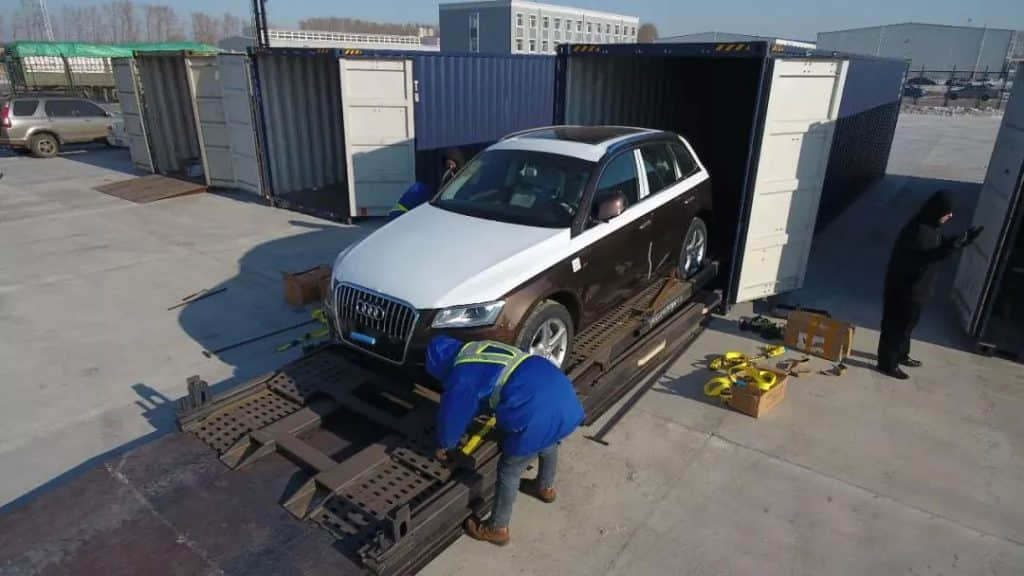

This regulation will have a huge impact on the car transfer business in Bishkek, Kyrgyzstan. In the past two years, due to the increase in the number of people from Russia coming to Kyrgyzstan to avoid taxes and buy cars, many car shows, workshops and document processing companies for car purchases in Bishkek, the capital of Kyrgyzstan, including surrounding restaurants and hotels, have developed rapidly, such as A series of supporting industries related to automobiles have sprung up like mushrooms after a rain.

This decree is Decree No. 152 of the Government of the Russian Federation and will enter into force on April 1, 2024. Russia will introduce a new method to calculate the price of cars imported from Eurasian Economic Union (EAEU) countries including Armenia, Belarus, Kazakhstan and Kyrgyzstan.

To put it simply, cars entering Russia from these countries in the Eurasian Economic Union need to make up for all the fees saved when clearing cars locally, including customs duties, value-added tax and consumption tax. Russian customs will track and inspect payments made for imported cars in these countries of the Eurasian Economic Union and will combine any differences into scrappage fees.

For example, if a car is cleared in Bishkek, Kyrgyzstan, and a customs duty of 3,000 euros is paid, and according to Russian customs regulations, the car needs to pay a customs duty of 13,000 euros, then the underpayment of 10,000 euros will be calculated into the scrappage fee. In addition, you also need to pay the difference in fees such as value-added tax and consumption tax. The vehicle can be legalized in Russia only after paying the full difference.

According to calculations by Russian customs experts, the difference between the gray customs clearance fees for a tank 300 and a Ji Krypton 001 in the Eurasian Economic Union countries is more than 1 million rubles and more than 2 million rubles respectively. In the past two years, due to the relatively short supply of Russian car models, the Russian government has no control over these gray customs clearance channels and has left them unchecked. This has also caused huge pressure and impact on the regular imported car business channels.

Cars from China and South Korea will have a huge cost difference when they are exported to Russia after passing gray customs clearance in the Eurasian Economic Union member states. As reported by the Russian media, merchants submit customs declaration forms to Russian Customs for customs clearance. The customs will ask the merchant to provide the true price of the car. If customs clearance is done at Kyrgyzstan Customs, Bishkek Customs will accept any declared price. . Therefore, this huge cost difference attracts a large number of Russians to buy cars in Kyrgyzstan.

In just over two years, the member countries of the Eurasian Economic Union, especially Kyrgyzstan, have rapidly developed into important distribution centers for automobiles in Asia. According to data released by relevant Russian departments, Li Auto sold nearly 1,700 vehicles in Russia in January 2024, most of which were imported from Kyrgyzstan. According to statistics from relevant departments of Kyrgyzstan, in the nearly three years from 2021 to 2023, the number of imported cars in Kyrgyzstan has continued to rise, reaching 13,000, 41,000 and 184,789 vehicles respectively.

When the ban is implemented, it will not only affect the automobile import and export transit business in Kyrgyzstan and other Eurasian Economic Union member countries, but will also have a far-reaching impact on China's automobile exports. In fact, most of the cars exported to Russia from various countries are operated and controlled by traders, and car manufacturers are only indirect beneficiaries. Russian experts predict that when Russia tightens regulations on imported cars, the price of parallel imported cars is expected to rise by nearly one-third, which will benefit some Chinese automakers and increase their exposure to Russia. Export amount.

In addition to the tightening of policies on the import of cars from Eurasian Economic Union member states, the certification of cars entering Russia will also be re-standardized.

This change in regulations will have a significant impact on Chinese automobile exports to Russia. The previous relaxation of Russian legal entities on the permitted import of Chinese goods will be cancelled.

Now, relevant companies must obtain OTTC certification for imported cars, which not only increases the complexity of the import process, but also increases the cost of imports. Relevant Russian authorities stipulate that imported Chinese cars need to comply with strict rules and procedures, including passive safety testing and certification, which is expected to take six months. Additionally, the licenses will be for specific production facilities, which will make the import process for different models produced in different factories extremely complex.

Experts from relevant Russian departments believe that the reduction in the sales volume of gray customs-cleared vehicles in Russia will not have a fundamental impact or change on the Russian automobile market. After April 1, some small companies and individuals will withdraw from related businesses, the number of entities with legal persons will increase, and automobile import traders will further develop into division of labor and collaboration. More small and medium-sized traders will cooperate with supply chain service providers and companies with stronger sales capabilities in Russia. Since Russian financial leasing companies are expected to be able to offset 20% of the value-added tax when purchasing cars, subsequent related business is expected to increase.

Chinese automobile brands operating in Russia and entering Russia through various channels currently include: Chery, Haval, Great Wall, Geely, GAC, Xingtu, Tank, Euler, Ideal, Warriors, Lantu, Dongfeng, Changan, Omoda, JAC, More than 20 car brands including Jikrypton, Lifan, Hongqi, BAIC, Kaiyi and Jietu. Chery, Geely, Changan and Haval, which has factories in Russia, etc., these car companies that have been operating in Russia for many years and are already familiar with various Russian certification regulations are expected to be positively affected by this regulation. Most of the cars that enter Russia through gray customs clearance due to Russia's loose policies will come back with nothing. The expensive certification fees and the competitive environment of oversupply will deter them.